Have you ever wondered how to solve a problem amid uncertainty? Do you know how large companies anticipate risks and arrive at forecasts in such situations? Imagine if there was a method suitable for unknown results and complex data sets; that's Monte Carlo simulation.

In this comprehensive article, the Monte Carlo simulation will first be introduced with its definition, and then its background will be shared with you. It will then explain why it is important and show use cases with examples. Finally, the article will end by discussing how it works and its pros and cons.

What is the Monte Carlo simulation?

Monte Carlo simulation is a powerful analysis method that provides different results for events and processes that are difficult to predict.

It usually gets input from historical data. Monte Carlo simulations are a preferred technique to ward off uncertainty and risk, so they are used to combat problems in a wide range of fields. However, applications may differ depending on each field. For example, Monte Carlo simulations in finance may be slightly different from Monte Carlo simulations in project management.

Background of the Monte Carlo simulation

In its modern sense, Monte Carlo simulation is a method first developed by Stanislaw Ulam in the late 1940s. It provided what physicists needed to solve some problems: accounting for chance and randomness. It takes its name from the Monte Carlo Casino in Monaco. This name was not only related to the randomness of casino games but also got its name from Ulam's uncle's casino habit.

This technique, especially with the invention of the first computers, allowed complex mathematical problems to be solved by the random sampling method. Primarily used for nuclear physics problems, this method was quickly adopted by other fields thanks to its excellent results. It has now become one of the essential tools used by the business world and engineering when performing risk analysis.

Why is the Monte Carlo simulation important?

Monte Carlo simulation is considered one of the most successful and impressive ideas of the twentieth century. Thanks to its ability to solve many complex physics and financial problems, it has been a preferred mathematics technique in science and technology. Apart from that, the key reason for its significance is:

Advantages of using the Monte Carlo Simulation

🗝️It allows preparation for uncertain future events. Thus, risk mitigation is more easily achieved.

🗝️Don't see this as just a method used by companies or scientists to make future predictions. It is versatile; as long as you have data, you can simulate many scenarios of daily life problems.

🗝️It offers different perspectives on the event by presenting unthinkable or invisible scenarios to the human eye.

🗝️Unlike approaches focused on inputs and outputs, it carries out a more comprehensive predictive analysis.

Use cases of the model

Monte Carlo simulation is a method that you can easily use in many fields, from logistics to marketing, finance, engineering, and physics. The following are some Monte Carlo simulation real-life examples:

Example #1

A telephone line company can use simulation to anticipate potential hazards in a new market. It creates a simulation plane by taking into account many variables such as demand-supply, advertising cost, competing companies, subscription fees, and number of subscribers. As a result of simulations, it provides insights into whether this business is profitable or not.

Example #2

A logistics company that handles city-to-city transportation needs to optimize its operations. The company wants to use the simulation to ensure timely deliveries, minimize costs, and manage risks associated with variable factors such as traffic congestion, accident probabilities, demand fluctuations, toll costs, and fuel prices.

Even though there are so many variables and uncertainties, with simulations, the company can take the necessary precautions and improve its business.

How does the Monte Carlo simulation work?

In a Monte Carlo simulation, you start by defining a domain of possible inputs. Then, you randomly generate inputs with a probability distribution over the domain. For example, if probability distribution is normal, then you need mean and standard deviation.

You perform a deterministic simulation of the outputs and sum up the results. It is especially suitable for research with many variables and large samples. The computer system needs to receive very intense input to produce scenarios similar to the real world. It then tries to detect uncertainties using random number generators.

To give a simple example of this seemingly complex system, the chance of tossing a coin could be an example of this. No matter how many times you throw the coin in a row, you never know if you will get tails twice in a row. Theoretically, the probability of getting tails twice is twenty-five percent, but the more number of times simulations you make, the more confident you can be in the outcome. So, a hundred scenarios will always be more consistent than fifty.

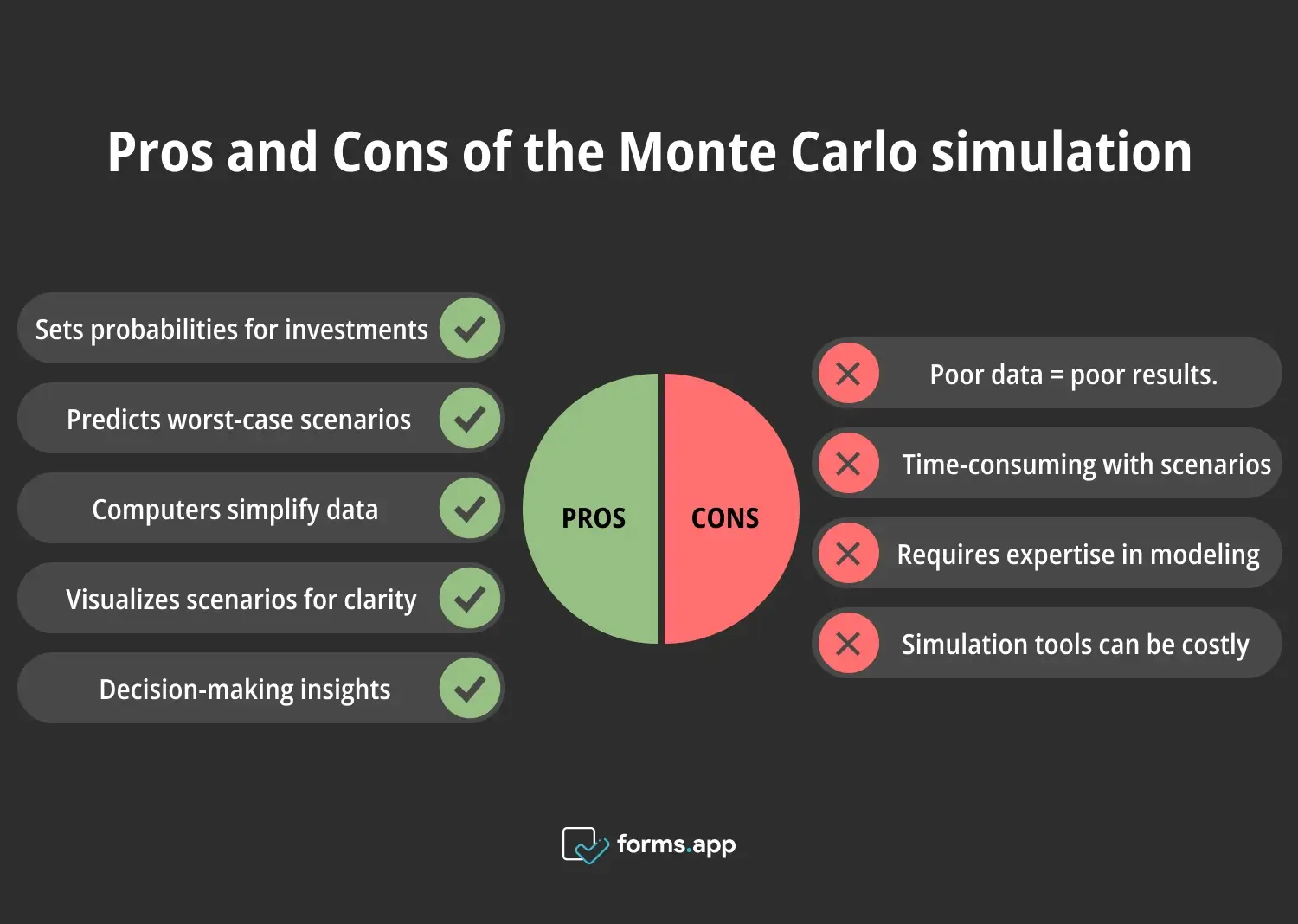

Pros & Cons of the model

So far, examples of the use of the Monte Carlo technique have been given. Now, you will read the pros and cons that you need to consider when using this technique.

Advantages & disadvantages of the Monte Carlo simulation

Pros

- It is used to estimate the probability of situations such as gain and loss in investments and long-term plans. It is good for showing worst-case scenarios and predicting future outcomes.

- It helps you understand complex datasets thanks to its computer-aided calculations.

- It allows you to understand scenarios better by visualizing them with appropriate tools.

- It provides practical suggestions with a wide range of scenarios in decision-making and formation situations.

Cons

- The output quality is directly proportional to input quality. Incomplete or bad data results in poor calculation of probabilities.

- Finding the required large sample and examining hundreds of scenarios as a result of simulation can be time-consuming.

- Since computer and modeling knowledge is required, researchers who are experts in the field may be needed.

- The computer software and tools required for simulation and data collection for research can be costly.

Frequently asked questions about the Monte Carlo simulation

In this section, you can find what you want to learn about Monte Carlo simulation more quickly and directly.

Monte Carlo simulation is a computational algorithm used to model the range of possible outcomes for unpredictable events. It is used when there are many random variables. It is very important to calculate risks in areas such as engineering, marketing, management, and finance. The scenarios created by the simulation are perfect for risk management and prediction in these fields.

Roughly, the five steps of the Monte Carlo simulation are:

1. Start by answering questions like: What is the problem? What will the analysis process be like? What are the key variables?

2. Create a mathematical model suitable for the analysis process. Have something that includes them all, taking into account the variables.

3. You must create large volumes of samples to create many different scenarios.

4. Run the simulation using random samples.

5. Finalize your research by evaluating the scenario results.

The Monte Carlo statistical method can be used to make predictions in a field such as engineering. For example, it can be applied to estimate a structure's lifespan. According to the materials used and load conditions, a bridge can be simulated.

The method estimates the durability and life of a bridge based on hundreds or even thousands of simulations. Thus, problems in the design of a structure can be resolved before they arise.

In short, yes, you can. Excel is perfect for an analysis that requires mathematical modeling, such as Monte Carlo simulation. It is a useful tool both in itself and with its add-ins (e.g., @RISK, Crystal Ball) to perform the necessary functions and calculations.

You can create a Monte Carlo simulation in a few steps in a program such as Excel. First, determine your model according to your research problem and note the equations and variables that fit this model.

Then, random samples will be created by determining the probability distribution. Repeat these formulas many times, collect the results in a table, and extract statistics. Now, you can visualize and start interpreting the results with chart tools in Excel.

Final words

Overall, Monte Carlo simulation is an important method for measuring risk and shedding light on future risks and uncertainties. Many different disciplines use this method to solve many different complex problems. However, as stated in the article, these processes can now be carried out quite easily with the help of computers and software. To help you get to know this useful method better, we started the article with its definition.

Then, its history and why it is important was mentioned. You were provided with Monte Carlo simulation examples to help you understand the topic better. Finally, we have come to the end of the article by listing how it works and its positive and negative aspects. Now, you can perform this useful analysis using what you have learned.

Atakan is a content writer at forms.app. He likes to research various fields like history, sociology, and psychology. He knows English and Korean. His expertise lies in data analysis, data types, and methods.